Predicting anything with absolute certainty is hard. Back in the 1980s, no one would’ve even imagined computers with processors that go up to 4.6 GHz and 16 GB of RAM when all they had access to were 4.7MHz processors and 2kb of RAM. In the 1990s, no one would’ve guessed the Internet would’ve turned into its modern iteration when all they saw were tiled low-res backgrounds, HTML tables upon HTML tables, and dial-up connections. With new advancements in technology, humanity’s growth has become exponential. New things better than the last seem to be created every other year. And now, as crypto and NFTs begin to cement their place in the world, we are active participants in the beginning of a new era of the Internet. People have been dubbing it web3.

There is not a consensus of what web3 is. In Cobie’s “Wtf is web3”, he proposes two important themes that emerge from the different definitions of what it could be: the decentralization of power and the ownership of value. As information and misinformation become rampant due to their ease of access, people have become more wary of centralized power. They feel that the government works against them, banks steal their money, and large companies control the world. Similarly, as the Internet changed from “read” to “read and write”, users have found their content monetized by modern tech companies. As in many other cases, the start of a new era begins as a response to the previous era. It is likely that whatever gets built during this time will emerge as an interpretation of those two important themes.

The Cold-Blooded Truth

The current macroeconomic conditions indicate a high probability of a recession. Inflation accelerated to 8.5% in March, above the 7.9% from February that had the Federal Reserve moving to increase the federal funds rate by at least 0.25 points. With the newer data, they are most certainly looking into increasing it further.

In addition to the high levels of inflation, according to the United States Department of Labor, unemployment rate is at 3.6% as of March. This combination of high levels of inflation and low levels of unemployment does not bode well for the economic outlook of the country. Domash states that since 1955, there has never been a quarter with average inflation above 4% and unemployment below 5% that was not followed by a recession within the next two years.

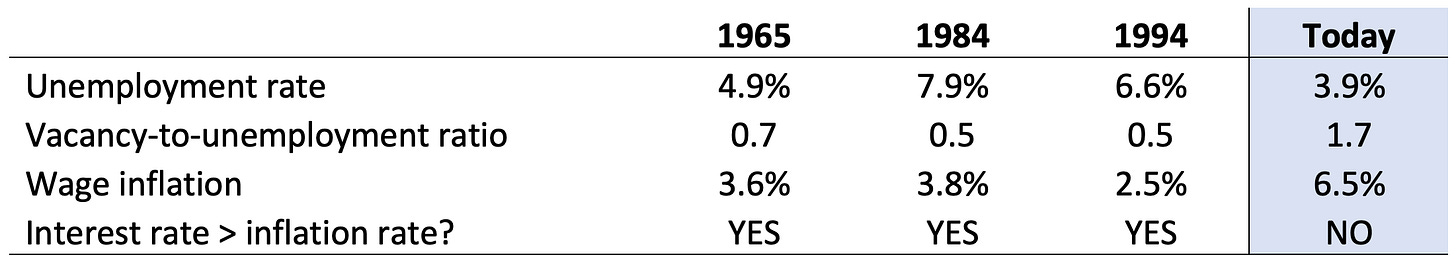

The data shows that the country is very likely to head into recession. While Fed Chair Jerome Powell has told lawmakers that he believes a soft landing ( a result where neither a recession nor high unemployment transpires) is “more likely than not,” the situation the country finds itself in is unprecedented. People have pointed to 1954, 1984, and 1994 as years that could be similar to what the US is experiencing right now. However, the other three occurrences had the Federal Reserve act preemptively to raise interest rates above inflation rates, rather than how it currently is where inflation has spiraled out of control. The Federal Reserve is playing catch-up in an attempt to reign in inflation. Mere speculation has already affected the markets in a negative way, and as they hammer down their policies, it will continue to do so.

While decentralization of power and the ownership of value are central themes of the next era of the Internet, reality shows otherwise. Cryptocurrency is still subject to the whims of the stock market.

Arthur Hayes points to this fact in “The Q-Trap.” As recently as April 10, Bitcoin registered 59.71% correlation with the NDX while Ether registered 63.87%. Taking a look at the longer 30- and 90-day correlations shows that correlation between the two is increasing. In the face of rising interest rates, worse global fiat liquidity conditions, and falling economic growth, big tech is expected to have a drawdown. With the high, increasing correlation of Bitcoin and Ether to NDX, crypto is predicted the follow suit.

Unless the correlation reverses, this means that our magic internet money will most likely drop in value. But what does that mean for our magic internet .jpegs?

A Link to the Past

Because cryptocurrency is still relatively new, to predict its future, people look for congruity in the past. They regularly point to the dot-com bubble as a comparison to Bitcoin’s price action. While the two are different, one can use the what happened back then as an indicator of what could happen in the future. The echoes of the past guides us to what lies ahead.

Thus, as the signs of a recession rears its head, one can look at The Great Recession from the late 2000s as a way to inform their decisions in the coming months.

Whether NFTs are considered art is a hotly debated topic outside (and even inside) of the crypto space. Even so, what cannot be debated is that people in crypto treat them like they have value. A large amount of money is being directed into buying these NFTs and attempting to make a brand out of them. The images are being used as a way to diversify their exposure to crypto.

High-end art is used in a comparable way. Pieces are bought for prestige, in the same way a person would don their NFT as a profile picture on Twitter. They are also bought as investments, in the same way that a person would buy an NFT and hold it to sell it in the future. This is not to say that all NFT projects could be analogous to works of art. The present state of the NFT market is mostly based on speculation, rather than any artistic merit. Despite this, similarities can be drawn to blue chip projects. People have assigned massive value to an image of an ape or a pixel art of a punk.

Masterworksio states that the effect of the turmoil in the global financial markets—which began in 2007—did not rear its head in the overall art market until 2009. That year, the art market experienced a sharp decline in the number of works being sold. The art market is said to typically lag behind equity markets by six to eighteen months, and the data from that era affirmed this thesis. And although the S&P 500 took until 2013 to return to its previous trading levels, by 2011, the market for public auction sales had already reached its previous levels.

The Mei Moses Index is an index that uses purchase prices of the same painting at two distinct moments in time to measure the change in value of unique works of art. As infrequently as art is sold, tracking repeat sales helps minimize the effects of its sporadic trading. Examining Mei Moses Index from those years confirms the delayed price action: from 2007 to 2009, auction prices fell by 27.2% while the S&P 500 fell 57% from its peak and a 12-year low in March. During the recession, the art world reverted to prices in 2004 to 2005 while the stock market reverted to prices from the late 90s.

A reason for this is that the art market self regulates supply and demand depending on the financial state of the world. With high liquidity, art changes hands more frequently — buyers have more money to spend. In uncertain times, owners are more likely to hold on to their pieces until the markets become favorable again. By holding on to their pieces, there is a reduction in supply, and prices remain relatively stable for the highest-end of art. As the graph above has shown, while prices could eventually drop during a recession, they also pick up faster than the stock market would. The prices during these downtimes could be seen as discounts.

If crypto continues with its high correlation to the NDX, one could possibly apply the same logic for the action of the art market to the NFT market. Many factors differ: different NFT projects offer different things in addition to the art that you purchase; the NFTs are neophytes compared to physical pieces of art; and NFTs are much more dependent on crypto than art is to fiat currency. However, this parallel could be used to inform your decision in the coming months. Stacking what you consider as blue chip projects at a discount could be a good way of retaining value during a possible recession.

But who knows? Maybe the correlation breaks and the crypto market as a whole stays strong while the world falls apart.

References

Cobie. "Wtf is web3." Cobie (Substack), April 13, 2022, https://cobie.substack.com/p/wtf-is-web3?s=r.

Domash, Alex. "Overheating conditions indicate high probability of a US recession." Last modified April 13, 2022, https://voxeu.org/article/overheating-conditions-indicate-high-probability-us-recession.

Hayes, Arthur. "The Q-Trap." Arthur Hayes (Medium), April 13, 2022, https://cryptohayes.medium.com/the-q-trap-f1a38312f00f.

Masterworksio. "What Happens to Art in a Financial Crisis?" Masterworksio (Medium), April 13, 2022, https://medium.com/@masterworksio/what-happens-to-art-in-a-financial-crisis-2cc9c20451b8.

I hope you enjoyed reading this. Right now, I can only write when I get inspired, so updates probably won’t come too often. I’m trying to get better at that. But subscribe, and hopefully, I can try to write something that you enjoy in the future.

If you feel compelled to tip in anyway, send to this address: 0x7Db280BA0fd96619D55Cd18270435A41e25948a4. It would be greatly appreciated if you do.

As always, nothing written here is financial advice.

Follow me on @kweejay on Twitter.